Government Efficient Roof Tac Credit 2017

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

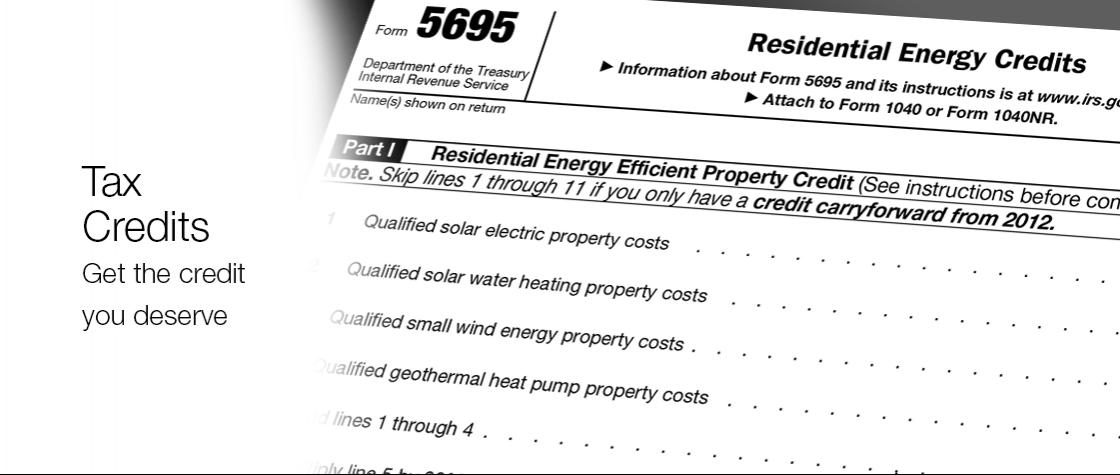

Government efficient roof tac credit 2017. Partial deductions of up to 60 per square foot can be taken for measures affecting any one of three building systems. The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020. Part of this credit is worth 10 percent of the cost of certain qualified energy saving items added to a taxpayer s main home last year. The deduction is available for buildings or systems placed in service after december 31 2017 through december 31 2020.

Qualifying properties are solar electric property solar water heaters geothermal heat pumps small wind turbines and fuel cell property. The building envelope lighting or heating and cooling systems. Part of the huge bipartisan budget act passed last month was an extension of tax credits for energy efficient upgrades to your home. The home must also be located in the united states.

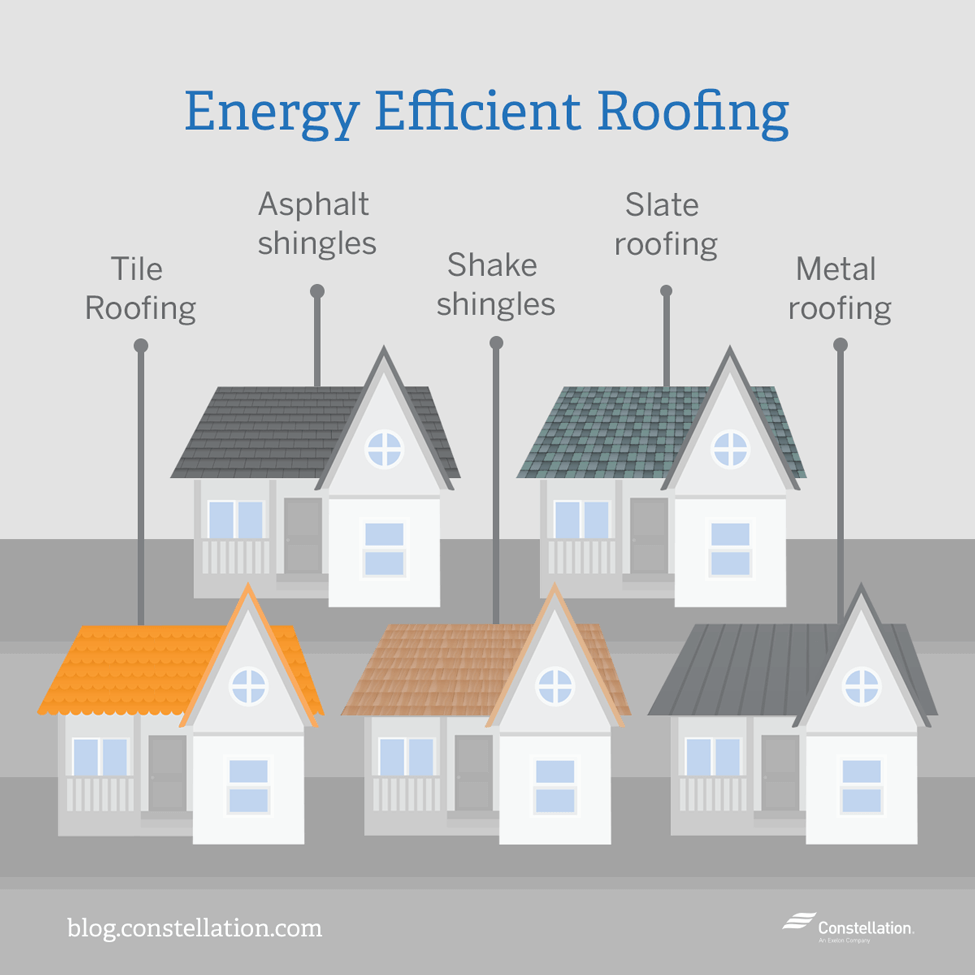

Non business energy property credit. You may claim a tax credit of 10 of cost of the qualified roofing product. Federal income tax credits and other incentives for energy efficiency. Qualified improvements include adding insulation energy efficient exterior windows and doors and certain roofs.

Here are some key facts to know about home energy tax credits. That means if you made any qualifying home improvements in 2017.